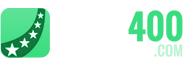

The visual road to becoming debt-free is a rigid one. And with the difficulties you’ll experience along the way, it is important that you have a couple of tools that can help you plan and make the process easier. One category of tools that have proven to be beneficial in managing debt is the debt payoff planner. You have the option to select between multiple mobile applications. For me, Savvy Debt Payoff Planner is a quality debt payoff planner.

Are you looking for the Best Debt Payoff Planner apps in 2020?

The best Debt Payoff Planner in 2020 would be certainlySavvy Debt Payoff Planner. This app is adeptly designed to help you repay all your debts and stay out of debt too. It can calculate, on your behalf, the smartest way to make monthly payments. And, the best part is, it is user-friendly.

![]() Primarily it saves the average user over $2,000 using the Savvy debt payoff method versus the Snowball debt payoff method. Savvy is ad-free and uses automation to make your life simpler. It is practical and offers good judgments about how to pay off your debts better to achieve debt freedom once and for all.

Primarily it saves the average user over $2,000 using the Savvy debt payoff method versus the Snowball debt payoff method. Savvy is ad-free and uses automation to make your life simpler. It is practical and offers good judgments about how to pay off your debts better to achieve debt freedom once and for all.

Ultimate Savvy Debt Payoff Planner Myths Explained

Savvy conveys to you what you pay and how much to pay towards each of your debts each month. Once your minimums are paid, Savvy will tell you where to put the extra money. The average user may save over $2,000 by using Savvy even after the monthly fee compared to using a debt payoff planner using the Snowball method based on a recent study.

Savvy was built using the proprietary Savvy debt payoff method. It’s not the snowball method or the avalanche method. Instead, the Savvy debt payoff method provides the psychological benefit from the Snowball method and the interest savings of Avalanche. It saves the average user over $2,000; you get out of debt faster. They shave a couple of months off of your debt freedom date together.

Pricing

For a limited time, try the Savvy app for free for 30 days followed by a monthly subscription of $5.99 (discounted from $9.99).

Things You Need to Know About Savvy Debt Payoff Planner

It allows users to add their accounts manually or automatically. Moreover, Savvy is designed to serve the busy population by permitting you to add your accounts automatically by giving read-only access to view transactions via your bank account. If people wary about security and/or you’d like to control the process, you can also add your accounts and your transactions manually.

In addition, Savvy protects your transaction information with read-only access and bank-level security via your financial institutions. Your data is safe which means it is not shared with third parties. Ascend connects to US financial institutions only.

Final Comments

Personal finance technology has come a long way. We’ve gone from using tax calculators to budget spreadsheets and now mobile apps. Fortunately, the Savvy Debt Payoff Planner app has the best features to assist you. You will see why it ranked #1 as the 2020 Best Debt Payoff App. In addition, you can also use this app to decide which debt you should target to repay first.